Analysing monetary policy communication in South Africa

In monetary policy communication, every word carries weight. Consider this scenario: the South African Reserve Bank (SARB) articulates its stance to anchor inflation expectations, yet this message undergoes subtle transformations when translated by the media and financial analysts. How do divergent narratives influence the outcome?

In the simplest form of communication, two parties are involved: the sender and the recipient. In the context of monetary policy, the sender is the central bank and one of the recipients is the public. One of the goals of the central bank's communication is to anchor inflation expectations, a necessary condition for maintaining price stability. Communication serves as a tool to enhance central bank transparency, which is essential for effective monetary policymaking.

Yet the central bank's message is only sometimes what the public receives. When the central bank's message is misinterpreted by the media and financial analysts, it can lead to confusion and uncertainty among the public and market participants. Misunderstandings or miscommunications about the central bank's stance on inflation expectations can result in unfavorauble market reactions, and potential volatility in financial markets. Moreover, if the public loses trust in the central bank's ability to effectively communicate its monetary policy objectives, it may undermine the central bank's credibility and effectiveness in achieving its mandate of price stability. Therefore, the divergence between the intended message and its interpretation by the public can hinder the central bank's ability to achieve its policy objectives and maintain macroeconomic stability.

Actors in monetary policy discourse

It is worth noting that media articles about monetary policy result from a complex interaction between different stakeholders, including journalists, the central bank, financial analysts, and other experts. These actors influence the message that eventually reaches the public. However, it is essential to acknowledge that each participant operates within a framework of their motivations and limitations regarding communication. We know little about how these players interact, how their messages may differ, or the extent to which this influences how effective monetary policymaking communication is.

A textual analysis of South Africa's monetary policy voices

In my SA-TIED Working Paper, I explore the network of individuals that influence the media's inflation message in South Africa. I investigate the narrative differences between the various players who talk about monetary policy in South Africa, using their original messages. The three sources I cover are the news media (journalists), the South African Reserve Bank (SARB), and financial analysts as represented by Investec Ltd. I employ a simple textual analysis to explore the different narratives of the three sources. The first is the news media, which includes newspaper articles from 2013 to 2022, searched on a database using the terms ‘monetary policy’, ‘SARB’, and ‘inflation’. From the central bank's point of view, I use the main document produced after each of the SARB's Monetary Policy Committee (MPC) meetings, entitled the Statement of the Monetary Policy Committee. Investec Ltd. economists are featured strongly in the news media, and therefore, I analyse their publicly available economic reports as representative of financial analysts. These documents are published weekly by an Investec publication entitled Focus.

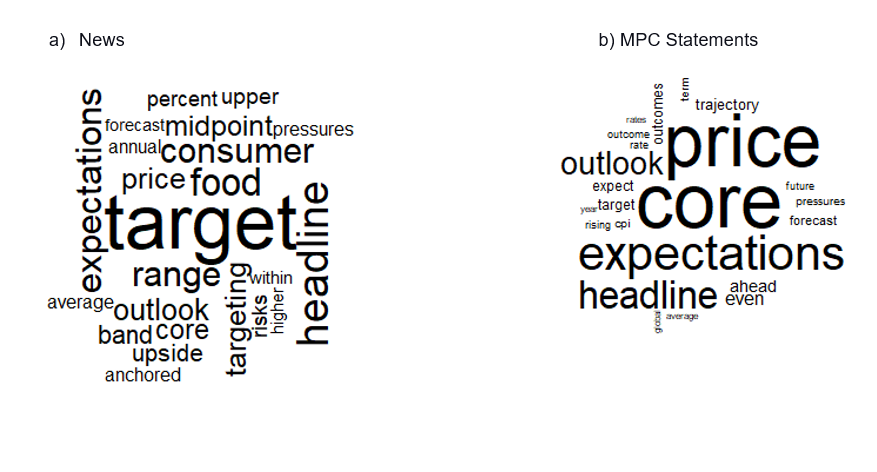

The word clouds show the varying feature associations. Feature associations refer to the relationship between words or terms and the features they represent. Figure 1 shows the words associated with inflation between the different sources. For example, MPC statements include narrower discussions about inflation, with bigrams—a unit of two words, letters, or symbols that occur together in a text—such as ‘core inflation’, ‘inflation expectations’, and ‘price inflation’ appearing more frequently.

On the other hand, newspapers more often discuss how inflation relates to the target, using words such as ‘target’, ‘targeting’, ‘band’, ‘midpoint’, ‘upper’, and ‘anchored’. This may imply that the media is concerned with inflation insofar as it stays within the target. The media also puts greater emphasis on ‘consumer inflation’ and ‘food inflation’ compared to the MPC statements—but less so than the financial analysts, who use words such as ‘food’, ‘manufactured’, and ‘fuel’ more readily in the context of inflation. Like the news, financial analysts also talk more about current and past inflation developments, with less variation in the number of words they use about inflation.

This simple exercise exposes subtle variations in how inflation is discussed by the different sources. It becomes clear that in monetary policy communication, each word plays a role in shaping our ability to interpret and respond to these nuanced narratives on our current economic outlook. By showcasing the dynamics of monetary policy communication, we shed light on a fundamental aspect of economic governance that directly impacts the lives of individuals and communities. Our data compel us to question not only how monetary policy decisions are made but also how they align with broader societal goals, such as unemployment (which is at 41.1% in Q4 of 2023 in South Africa) and sustainable economic growth. Ultimately, this research serves as a call to action for greater public engagement and awareness in economic policymaking.