South Africa’s emergency social grant proves to be a critical tool in the fight against poverty — it should be expanded

South Africa's unemployment rate stands at a staggering 32.1%—one of the highest in the world. Coupled with an alarming poverty rate, where nearly half of the population lives below the poverty line, the socioeconomic landscape is dire. Amidst these challenges, the special COVID-19 Social Relief of Distress (SRD) grant is a critical tool in the fight against poverty and unemployment.

However, with the recent extension of the SRD grant to March 2025, and a reduced budget allocation of ZAR 34 billion—down from ZAR 44 billion in 2022, and ZAR 36 billion in 2023—we believe there is an urgent need to reevaluate its design to maximize its effectiveness. This past year, the SRD grant supported more than 8.5 million individuals living in extreme poverty (below the food poverty line) with a budget of ZAR 36 billion (USD 1.927 billion). We estimate that the grant reduced the number of individuals living in extreme poverty by roughly 4 million. This is a reduction of approximately 25% in the incidence of extreme poverty. A qualitative report by the Black Sash, a South African human rights organization, highlights the empowering impact of the SRD grant on its beneficiaries. It underscores that the grant provides these individuals with a sense of dignity, allowing them to support their families’ livelihoods without having to rely on begging or borrowing money.

The SRD grant supports employment, too

Even though it provides no additional services and attaches no conditions, the SRD grant enables recipients to search for work or start small businesses. Studies have found that the SRD grant increases the probability of searching for a job by 25%, allows grant beneficiaries to pay for transport costs associated with a job search, and to start small businesses or invest in assets to make their businesses more productive.Given the effectiveness of the special COVID-19 SRD grant in reducing poverty and supporting employment, can we recommend improvements to its design? In our study SA-TIED programme, we model several design options and simulate their impacts on poverty levels, the amount of individuals who receive the grant, and the expense to the public budget.

To do this, we update the 2014/15 Living Conditions Survey to simulate the present-day South African economy and demographics. This data is then used to model the likely impacts of various grant design options. Our results assume the grant is ‘perfectly’ targeted. Given the imperfect nature of the current ‘banking means test’, an assessment of an individual or family’s eligibility for social assistance or welfare, the results may slightly underestimate the actual cost and slightly overestimate the impact on poverty reduction.

Raising the size of the grant more effectively reduces extreme poverty

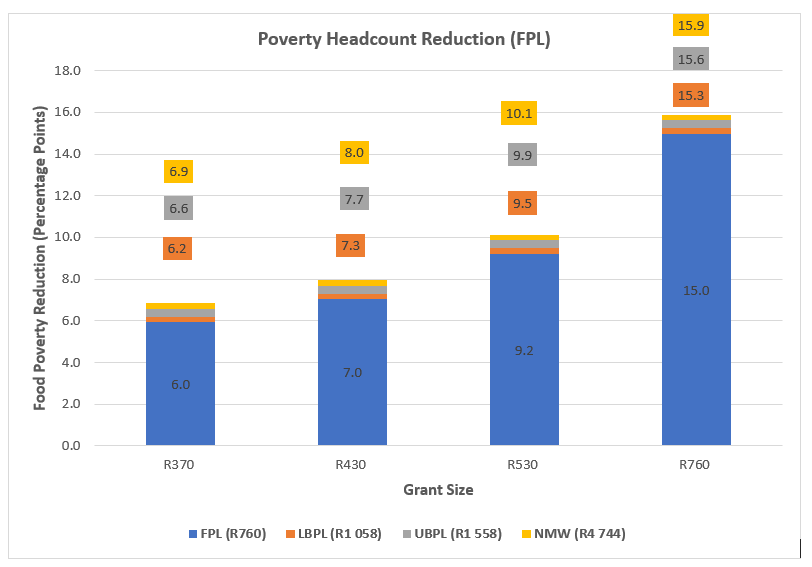

Our simulations explored the impact of maintaining the current monthly grant amount (ZAR 370) at different poverty lines: the 2023 food poverty line (ZAR 760), lower bound poverty line (ZAR 1,058), upper bound poverty line (ZAR 1,558) and national minimum wage (ZAR 4,744). At the food poverty line, the total annual cost of the ZAR 370 SRD grant is ZAR 30.9 billion, slightly below the current budget allocation. We found a 6.0 percentage point reduction (24%) in extreme poverty for roughly 4 million recipients (Figure 1).

Raising the eligibility threshold to the lower bound poverty line increases the total cost of the grant to ZAR 41.6 billion, suggesting the current ZAR 34 billion budget is insufficient. Alternatively, increasing the grant amount to ZAR 430 (the original SRD grant adjusted for inflation), or ZAR 530 (current Child Support Grant value) raises the total cost of the grant to ZAR 35.9 billion and ZAR 44.3 billion, respectively. Our simulations suggest that increasing the size of the grant is significantly more effective at reducing the incidence of extreme poverty compared to raising the eligibility threshold. For example, raising the threshold to the lower bound poverty line without raising the grant size reduces extreme poverty by 0.2 percentage points compared to the 1.0 percentage point reduction achieved by increasing the size of the grant to ZAR 430. Therefore, if fiscal constraints force tradeoffs to be made, we recommend increasing the grant size over the eligibility threshold.

Figure 1

Source: Authors’ estimates based on LCS 2014/15, updated using the QLFS 2015 & 2021

Note: acronyms are food poverty line (FPL), lower bound poverty line (LBPL), upper bound poverty line (UBPL), and national minimum wage (NMW).

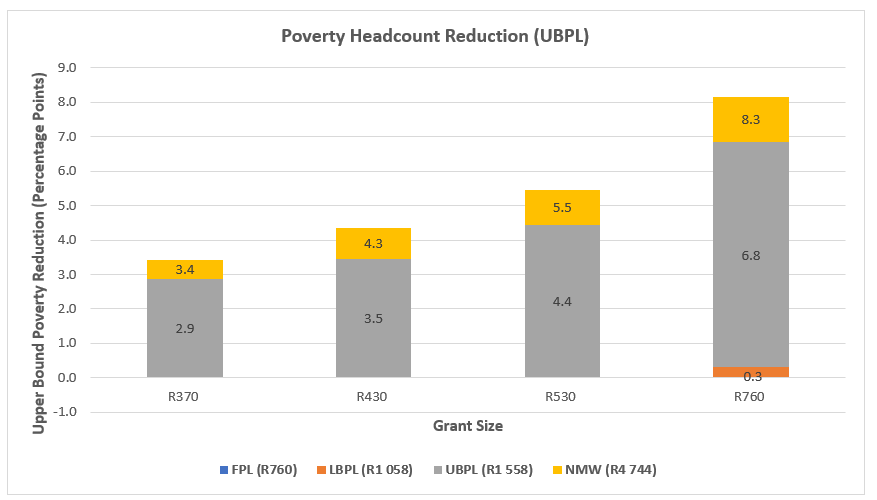

What would happen if both the grant size and eligibility threshold are raised?

Raising the eligibility ceiling expands coverage and includes those who are now excluded from the grant due to faults in the method of means testing. Leaving the current eligibility criteria unchanged, except for the income threshold, South Africa could expand support to all those living below the upper-bound poverty line with a budget of ZAR 55.5 billion. This would support individuals living in poverty even if the grant size is not large enough to take them out of poverty at the national poverty lines. To have a bigger impact on the poverty headcount, both the amount of the grant and the eligibility threshold need to be increased.

Figure 2

Cost-effective design improvements

Additionally, the grant can be improved with the following two modifications: first, dropping the Unemployment Insurance Fund (UIF) exclusion criterion and, second, to assess an individual’s income as an aggregate over six months rather than the most recent. The UIF exclusion criterion likely omits many eligible beneficiaries as UIF data is updated infrequently and often inaccurately. Further, the exclusion criterion may discourage individuals from registering for UIF. Averaging income over 6 months prevents individuals who receive a windfall, such as a severance pay, but nonetheless remain poor over time from being excluded. These modifications do not lead to drastic increases in beneficiary numbers or the total cost of the grant but limit the extent of unfair exclusions.

We also propose moving away from the current banking means test in favor of self-reported income. Since April 2022, eligibility for the grant is determined by analysis of total monthly inflows into an applicants’ bank account. But total inflows sometimes include household transfers and loans, which often leads to overestimates that disqualify those who should qualify. Finally, we suggest offering additional active labour market services to grant recipients to support their job search, with any add-ons rigorously evaluated and phased in based on available evidence and costs.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.