The COVID-19 TERS policy saved at least 2 million jobs - but not without some unintended results

Tim Köhler, Haroon Bhorat, Robert Hill, 26 May 2023

About three years have passed since the South African government introduced the COVID-19 Temporary Employer-Employee Relief Scheme (TERS) in response to the pandemic and associated lockdown regulations. Given the extent of unemployment in South Africa even prior to the pandemic, the policy’s primary aim of mitigating job losses arguably made it one of the country’s most important labour-market interventions at the time. What effect did it have on job retention, and who did it benefit most?

Introduction

The Temporary Employer-Employee Relief Scheme, introduced in 2020 as the Covid-19 pandemic swept the country, effectively served as a wage subsidy – the predominant policy used by governments around the world to save jobs in response to the pandemic. By January 2022, 60% of countries had introduced some form of wage subsidy.[1] While these policies vary in design, by subsidising worker incomes and firm liquidity, they broadly seek to help employers retain workers and avoid the potentially costly process of hiring and training new workers as economic activity recovers. They also help workers avoid adverse labour-market ‘scarring effects’ associated with periods of unemployment.

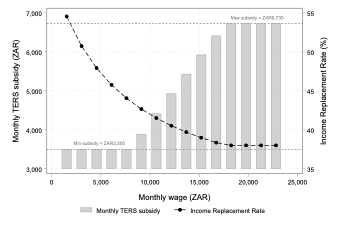

In brief, the TERS subsidised the incomes of workers who remained employed but had suffered income loss as a result of a full or partial closure of their employers’ operations due to the pandemic. Subsidy amounts varied between a minimum of R3 500 and maximum of R6 730 per worker per month, depending on a worker’s wage, and were calculated using the unemployment insurance benefit formula laid out in South Africa’s Unemployment Insurance Act. Figure 1 below illustrates how subsidy amounts varied depending on an eligible worker’s wage. Importantly, the policy ensured that higher-wage workers received larger subsidies in absolute terms, but that lower-wage workers received larger subsidies in relative terms (the share of their usual wage subsidised).

Figure 1: Simulation of the calculation of TERS benefits

Source: Köhler, Bhorat, and Hill (2023).

The TERS was subject to various extensions and amendments throughout 2020 and 2021, with a final claim period in July 2021. By its termination, nearly 6 million unique workers (equivalent to approximately 70% of the formal, private sector employed population in 2020) had benefited from the policy at a cost of R64 billion.[2](For a detailed description of the evolution of the policy, see Köhler and Hill (2022).)

In our previous work summarised in this Econ3x3 article a year ago, we found a strong, positive association between TERS receipt and job retention – that is, the probability of remaining employed – during the beginning of the pandemic. While this provided suggestive evidence about the efficacy of the policy, our method only allowed us to establish a correlational relationship (“Are TERS recipients more likely to remain employed?”) and not a causal one (“Does TERS receipt itself increase the probability of remaining employed?”). As such, the key question “Did the TERS save jobs?” remained unanswered because adequate empirical evidence had yet to exist.

In our new working paper, which was initially produced with support from the United Nations University World Institute for Development Economics Research (UNU-WIDER), we provide the first estimates of the causal effect of the TERS on job retention. We outline our approach in more detail below. While our analysis allows us to finally answer the question “Did the TERS save jobs?”, it also has broader implications for the developing world. While several studies of the causal job retention effects of wage subsidies during the pandemic exist for developed countries, such as the US, Canada, and Australia, to our knowledge our analysis provides the first set of estimates for a developing country, typically characterised by a markedly different labour market.

Data and methodology

Our approach relies on a temporary eligibility criterion in place during the beginning of the TERS policy. For its first two months, eligibility was restricted to UIF-contributing workers. This included most of the employed population (8.5 million or 52% of workers as of the first quarter of 2020)[3] given that most workers are legally required to be registered and contribute to the UIF.[4] Informal sector and UIF non-contributing formal sector workers were thus excluded. Following legal challenges, eligibility was later expanded from the end of May 2020 to include any worker who could prove an existing employment relationship, whether they were a UIF-contributor or not.

The existence of this criterion allows us to establish causality through the use of a Difference-in-Differences model applied on representative panel labour force survey data (Statistics South Africa’s Quarterly Labour Force Surveys for the first half of 2020). Simply put, our model compares the job-retention probabilities of TERS-eligible and ineligible employees from before the policy was introduced with afterwards. Given the strong, positive association between UIF contribution and employment formality in the South African labour market, we restrict our sample to formal private-sector employees, who constitute the majority of workers in the country, to ensure that our results do not simply speak to the differential employment trends between formal and informal sector workers.

Importantly, because TERS subsidy amounts varied depending on a worker’s wage as shown in Figure 1above, we additionally analyse whether the policy’s effect varied depending on the size of the subsidy in both absolute (Rands) and relative (the share of their wage subsided, or subsidisation rate) terms. Such an analysis is useful as it sheds light on the effect of changes in subsidy rates as opposed to the effect of receipt of the subsidy alone, regardless of its intensity.

The TERS saved jobs

Overall, we find evidence of a statistically significant and positive effect of the TERS policy on job retention in the short term. Specifically, our preferred model shows that the TERS increased the probability of remaining employed by nearly 16 percentage points during April and May 2020 (see Table 1 below). The size of this effect varies only marginally (between 15.5 and 17.8 percentage points) across different model specifications that account for differences between TERS-eligible and ineligible workers, such as age, gender, industry, and occupation. Interestingly, this effect is similar to the estimate we found in our previous work where we used a different dataset and method. However, our new estimates are much more precise. Together, these results indicate that the TERS was successful in its primary aim of saving jobs, at least in the short term.

Table 1: Effect estimates of the TERS policy on job retention

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Effect estimate |

0.175*** |

0.178*** |

0.155*** |

0.175*** |

0.174*** |

0.156*** |

|

(0.022) |

(0.022) |

(0.022) |

(0.022) |

(0.023) |

(0.022) |

|

|

Demographic controls |

No |

Yes |

Yes |

No |

Yes |

Yes |

|

Labour market controls |

No |

No |

Yes |

No |

No |

Yes |

|

Individual fixed effects |

No |

No |

No |

Yes |

Yes |

Yes |

|

Constant |

1.000*** |

0.720*** |

0.850*** |

1.000*** |

3.345*** |

3.831*** |

|

(0.000) |

(0.075) |

(0.075) |

(0.004) |

(1.017) |

(0.965) |

|

|

Observations |

8 520 |

8 450 |

8 303 |

8 520 |

8 450 |

8 303 |

|

R2 |

0.114 |

0.129 |

0.165 |

0.560 |

0.561 |

0.558 |

Source: Köhler, Bhorat, and Hill (2023).

Notes: This table presents the effect estimates of TERS eligibility on job retention as per equation (1) in Köhler, Bhorat, and Hill (2023). Standard errors presented in parentheses and are clustered at the panel level. *** p < 0.01, ** p < 0.05, * p < 0.10.

This effect is not only positive but is also economically meaningful. First, the effect above refers to the effect of being TERS-eligible, which would understate the effect of actual TERS receipt because not all eligible workers received the TERS To estimate the effect of TERS receipt, we follow several studies in the literature and apply a scaling factor to our estimate using a combination of survey and administrative data.[5] By doing so, we find that 33% of TERS recipients would have lost their jobs had they not received the subsidy during April and May 2020. This then translates to the TERS having saved 2.7 million jobs during the period. We conduct a number of robustness tests, which all support the positive effects of the policy and together provide a lower-bound effect of about 2 million jobs saved. Overall, this strongly suggests that the extent of job loss at the pandemic’s onset would have been much more severe in the absence of the policy.

But its effects were regressively distributed

However, the effect varied depending on the size of the subsidy: while effects were large and positive regardless of the size of a recipient’s subsidy in either absolute or relative terms, they were marginally regressively distributed. In other words, they were higher for workers who received larger subsidies in absolute terms – i.e., those earning higher wages.

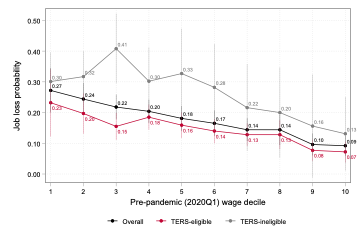

This isn’t good news from an inequality perspective. One might argue that this distribution of effects may at least partially explain the fact that job loss at the pandemic’s onset was concentrated on lower-wage workers in South Africa. So we examined how the likelihood of job loss at the start of the pandemic differed across the wage distribution by TERS eligibility status (see Figure 2 below). However, we do not find any evidence that the regressivity of TERS effects explained lower-wage workers’ greater vulnerability to job loss. While TERS-eligible workers faced lower job loss probabilities relative to ineligible workers across the entire distribution, which is in line with our findings above, we continue to observe a regressive job-loss distribution even among TERS-eligible workers. So it appears that the regressive distribution of job loss is explained by factors other than the policy itself.

Figure 2: Job loss probabilities across the wage distribution by TERS eligibility status

Source: Köhler, Bhorat, and Hill (2023).

As noted, the policy ensured that the lowest subsidy amount would not be lower than the national minimum wage of R3 500 per month. Given the well-documented extent of minimum wage non-compliance in the South African labour market,[6] it is not surprising then that many workers received subsidies that exceeded their usual wages. These wages were then effectively not only subsidised but ‘topped-up’ and increased. We estimate that this affected nearly a third (30%) of all eligible workers. We however do not find any evidence that the job-retention effects of the TERS varied according to whether a worker received a subsidy larger than their usual wage or not.

Rapid disbursement rather than accurate targeting

By combining our estimate of the number of jobs saved with expenditure data, we can arrive at a simple measure of the cost-effectiveness of the policy. In doing so, we calculate that the average job saved cost just under R13 200 per month in nominal terms during the period. This is large relative to the median wage of eligible workers (R5 315), and nearly four times larger than the median TERS subsidy amount (R3 500). In other words, it appears that expenditure on the TERS exceeded the wage costs of jobs supported by it. Arguably, this likely reflects the fact that the policy initially prioritised rapid disbursement of relief over accurately targeting those most affected or in need. However, this high cost compares favourably to those in more developed countries. For instance, the cost per job saved by a similar policy in the US is approximately 3.5 times the median wage.

Moreover, the other side of the coin of our finding that 33% of TERS recipients would have lost their jobs had they not received the subsidy is the non-negligible share of ‘inframarginal’ workers: 67 percent of recipients would have remained employed anyway. This again likely reflects the policy’s initial prioritisation of rapid disbursement of relief over accurate targeting. While the policy indeed did not help this subgroup of workers remain employed, it still provided them with income support. Furthermore, this outcome was not unique to South Africa, but was found in other countries such as the US, Canada, and Australia.[7]

Conclusion

Until now, we have not had sufficient evidence to be able to conclude whether the South African government’s COVID-19 TERS policy was actually successful in its primary aim of saving jobs during the pandemic. In our new working paper, we provide the first estimates of the causal effect of the TERS in the short term. Our analysis yields both impressive and unpleasant results.

We show that the TERS did indeed save jobs: it increased the probability of remaining employed by just under 16 percentage points. This effect is not only positive but economically meaningful: It translates into 2.7 million jobs saved during April and May 2020. While job loss at the onset of the pandemic was substantial, our analysis makes it clear that it would have been much more severe in the absence of the policy. Moreover, the average cost per job saved is estimated at just under R13 200 per month, which compares favourably to the cost of similar policies in more developed countries.

On the other hand, we find that two in every three TERS recipients were inframarginal – that is, they would have remained employed anyway. This likely reflects the policy’s initial prioritisation of rapid disbursement of relief over accurately targeting those most in need. This does not, however, mean these funds were wasted as the policy still provided this subgroup of workers with income support. Another consequence of foregoing accurate targeting is the relatively high cost per job saved. While it compares favourably internationally, it is notably larger than both median wages and TERS subsidy amounts. In other words, expenditure on the policy greatly exceeded the wage costs of jobs supported by it. Finally, while job-retention effects are large and positive regardless of the subsidy amount, effects were marginally higher for higher-wage workers, i.e. they were somewhat regressive.

From a policymaking perspective, our analysis shows that wage subsidies can save a significant number of jobs during periods of crisis in a developing country, which is in line with the developed country consensus. However, there are consequences for foregoing careful targeting. From a research perspective, much remains to be done. Primarily, access to administrative data, such as the Unemployment Insurance Fund database, would allow researchers to examine longer-term dynamics as the policy was extended and became more targeted over time, and how the policy’s cost-effectiveness improved (or deteriorated) as these changes were made.

References

Autor, D., Cho, D., Crane, L.D., Goldar, M., Lutz, B., Montes, J., Peterman, W.B., Ratner, D., Villar, D. and Yildirmaz, A. 2022. ‘An evaluation of the paycheck protection program using administrative payroll microdata.’ Journal of Public Economics, 211: 104664.

Bhorat, H., Kanbur, R. and Mayet, N. 2012a. ‘Minimum wage violation in South Africa.’ International Labour Review, 151(3): 277-86.

Bhorat, H., Kanbur, R. and Mayet, N. 2012b. ‘Estimating the Causal Effect of Enforcement on Minimum Wage Compliance: The Case of South Africa.’ Review of Development Economics, 16(4): 608-23.

Bhorat, H., Kanbur, R. and Stanwix, B. 2015. ‘Partial minimum wage compliance.’ IZA Journal of Labor and Development, 4(18): 1-20.

Bhorat, H., Kanbur, R., Stanwix, B. and Thornton, A. 2021. ‘Measuring Multi-Dimensional Labour Law Violation with an Application to South Africa.’ British Journal of Industrial Relations, 59(3): 928-61.

Bishop, J. and Day, I. 2020. ‘How many jobs did JobKeeper keep?’ Reserve Bank of Australia Research Discussion Paper No. 2020-07.

Chetty, R., Friedman, J.N., Hendren, N., Stepner, M. and The Opportunity Insights Team. 2020. ‘How did Covid-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data.’ National Bureau of Economic Research Cambridge, MA.

Dalton, M. 2021. Putting the Paycheck Protection Program into perspective: An analysis using administrative and survey data. Working Paper No. 542. Bureau of Labor Statistics.

Gentilini, U., Almenfi, M.,Iyengar, H., Okamura, Y., Downes, J.A. Dale, P., Weber, M., Newhouse, D., Alas, C.R., Kamran, M., Mujica, I.V., Fontenez, M.B., Ezzat, M., Asieduah, S., Martinez, V.R.M., Hartley, G.J.R., Demarco, G., Abels, M., Zafar, U., Urteaga, E.R., Valleriani, G., Muhindo, J.V. and Aziz, S. 2022. Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures. Version 16. Washington, DC: World Bank. Available at: https://openknowledge.worldbank.org/handle/10986/37186[Accessed June 2022].

Köhler, T., and Hill, R. 2022. ‘Wage Subsidies and COVID-19: The Distribution and Dynamics of South Africa’s TERS Policy’. Development Southern Africa, 39(5): 689–721.

Köhler, T., Bhorat, H., and Hill, R. 2023. Wage Subsidies and Job Retention in a Developing Country: Evidence from South Africa. Development Policy Research Unit Working Paper 202302. DPRU, University of Cape Town.

Nxesi, T. (2022). ‘Two-Year Anniversary of the UIF’s Covid-19 TERS’, 4 April. Department of Employment and Labour, Republic of South Africa. Available at: https://www.labour.gov.za/Media-Desk/Media-Statements/Pages/Two-year-ann...’s-Covid-19-TERS.aspx (accessed June 2022).

Smart, M., Kronberg, M., Lesica, J., Leung, D. and Liu, H. 2023. The Employment Effects of a Pandemic Wage Subsidy. CESifo Working Paper No. 10218. Munich Society for the Promotion of Economic Research.

[1] Gentilini et al. (2022).

[2] Nxesi (2022).

[3] Own calculations using weighted microdata from StatsSA’s Quarterly Labour Force Survey for 2020Q1.

[4] Exceptions include workers who are employed with an employer for less than 24 hours per month, those who work for national or provincial government, foreign workers on contract, and workers who only earn a commission. This also includes workers who do not need to be registered for income tax purposes, such as those who earn below the tax threshold, and those who are not voluntarily registered.

[5] See Bishop and Day (2020), Autor et al. (2022), and our paper for more details of this approach.

[6] See Bhorat et al. (2012a; 2012b; 2015; 2021).

[7] See Bishop and Day (2020); Chetty et al. (2020); Dalton (2021); Autor et al. (2022); and Smart et al. (2023).