The tipping point: The impact of rising electricity tariffs on large firms in South Africa

Globally, technological changes have been occurring on multiple fronts in the electricity space: new and cheaper energy generation options, and the rise of distributed generation; improvements in storage technologies; new information systems enabling the Internet of Things and smart grids; new energy-related industry technologies such as electric vehicles, fuel cells, and logistics technologies, amongst others. These developments are resulting in lower electricity prices, as well as new ways for consumers to manage their electricity usage, sell power back into the grid, or become (partly or fully) independent of traditional grid-based electricity. While these developments are positive for electricity consumers, they are challenging for electricity providers with more traditional business models, and can lead to what is known as a utility ‘death spiral’ (O’Boyle 2017).

In South Africa’s case, the electricity sector is dominated by Eskom, a state-owned and integrated electricity provider. Around 90 per cent of the country’s electricity is generated by Eskom’s coalfired power stations (Eskom n.d.). There is minimal competition in the generation space from independent power producers, which are largely in the renewable space and have to sell power back to Eskom. Eskom has a monopoly on transmission, and also distributes power. Municipalities also act as distributors, accounting for about 40 per cent of electricity sales (Eskom 2017).

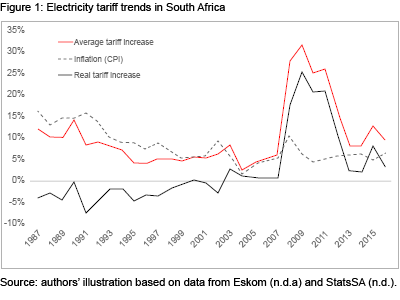

Electricity is generally a relatively small proportion of a firm’s overall operating expenditure or a household’s consumption expenditure, but it is nonetheless critical for the operation of machinery and the running of lights and appliances. Hence firms and individuals were relatively inelastic in their demand patterns when electricity prices were historically low in South Africa before 2008. In addition, the direct prices of alternatives energy sources at the time, and the indirect costs associated with the installation of the necessary infrastructure and the logistics of sourcing and obtaining it, meant there was little or no cross-price elasticity. Essentially, electricity demand was largely determined by the income effect, and for firms by output or value-added growth. However, starting in 2008, electricity prices in South Africa started to rise steeply (Figure 1), changing the relative costs of electricity with respect to alternative energy options and in relation to output prices. This in turn should have made consumers more elastic.

The price elasticity of demand for electricity, and the strongly related energy intensity of economic growth, has been difficult to estimate because of the current electricity shortfalls, which artificially constrain the market, thereby masking price elasticity effects. The timing of the price increases, which largely coincided with an economic recession, also make estimation difficult, as does the lumpy long-term nature of energy-intensive investments. Finally, the quality of data in South Africa, including the availability of municipal data and data disaggregated for sector-specific analysis, is problematic. Nevertheless, anecdotal evidence suggests that steep electricity price increases over recent years, combined with lower economic growth, low commodity prices, generally low inflation rates, and excess productive capacity in many countries around the world, means that many firms are under severe price pressure, and that electricity demand is more elastic.

With rising electricity prices in South Africa, there are a number of possible electricity cost ‘tipping points’ that might result in firms making decisions that significantly alter their electricity demand profiles, including:

- deciding to generate their own electricity,

- deciding not to invest any further,

- deciding to invest elsewhere in the region or in another sector,

- deciding to invest in large energy efficiency programmes, or

- deciding to shut down one or more parts of their business.

These kinds of decision will have large ramifications for Eskom sales, and for the South African economy more broadly. If firms choose to delay or cancel investment, or indeed to shut plants down, this will affect forecasts not only of economic growth, but also of electricity demand, and of how much supply is required to meet that demand. Whilst decisions to invest in other sectors may not affect growth, they will contribute to structural transformation, and could have an impact on variables such as employment and exports. The decision to build own-generation may be viewed by some in a positive light, as it is better than shutting down facilities and will result in some investment expenditure. However, it could have large impacts on Eskom’s revenue, and this in turn could have large implications for the average price level for those still supplied from the grid. Furthermore, it could impact the South African fiscus in terms of Eskom’s demands for government guarantees or recapitalization. A decision to invest in energy efficiency is generally viewed in a positive light (despite some potential decline in sales revenue for Eskom) in that firms will become less energy-intensive and potentially more competitive and sustainable, and it will contribute to environmental objectives whilst also contributing to investment expenditure.

This paper attempts to model where and when such tipping points might be reached, using financial information from 21 companies from various sectors in South Africa, cost information for own-generation technologies, and tariff increase scenarios. The literature review that follows highlights relevant research on demand elasticities and the effects of electricity tariff increases on various sectors, and an electricity tipping-point study previously commissioned by Eskom. This is followed by sections that look at the impact of electricity tariff increases on the operating profits of firms used in the study, and the ability of these firms to move their electricity consumption offgrid by investing in their own generation. The paper ends with concluding remarks.